West virginia revocation of power of attorney form may be utilized when you seek to terminate a power of attorney that you granted to an agent or agents generally most cases where an agent currently wields principal powers that must be terminated will call for an official revocation of the current appointment.

Revoke power of attorney form virginia.

Revocation the principal has the right to revoke this durable power of attorney form at anytime.

The execution of a power of attorney does not revoke a power of attorney previously executed by the principal unless the subsequent power of attorney provides that the previous power of attorney is revoked or that all other powers of attorney are revoked.

Power of attorney and declaration of representative form par 101 use this form to.

Witness notary this document is not valid as a durable power of attorney.

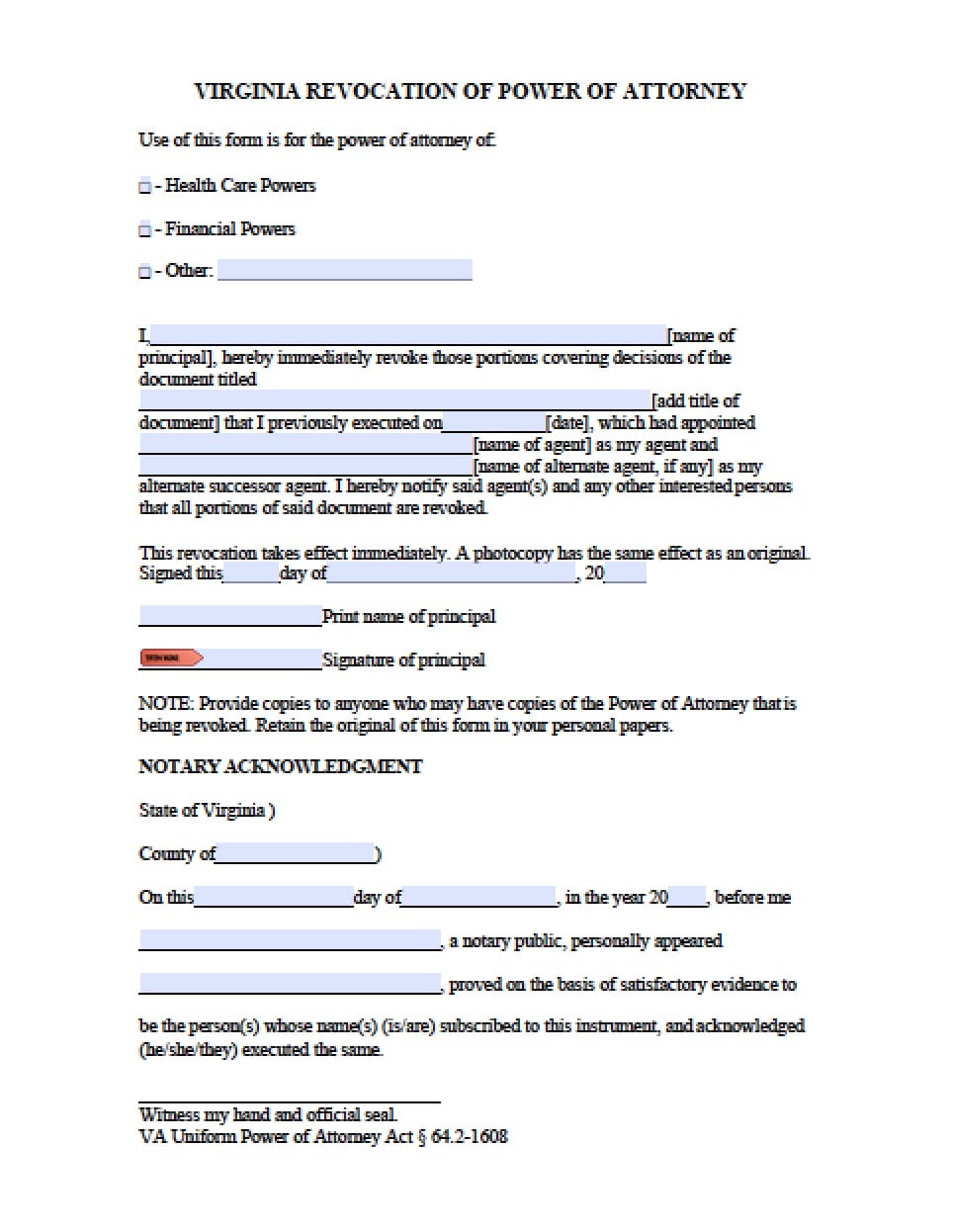

Virginia revocation of power of attorney form is used for revoking a poa that you already have executed in addition to filling out the form it is important that you provide notice to everyone who has a copy of your old poa by providing them with a copy of the revocation document.

The principal revokes the power of attorney.

The par 101 is a legal document.

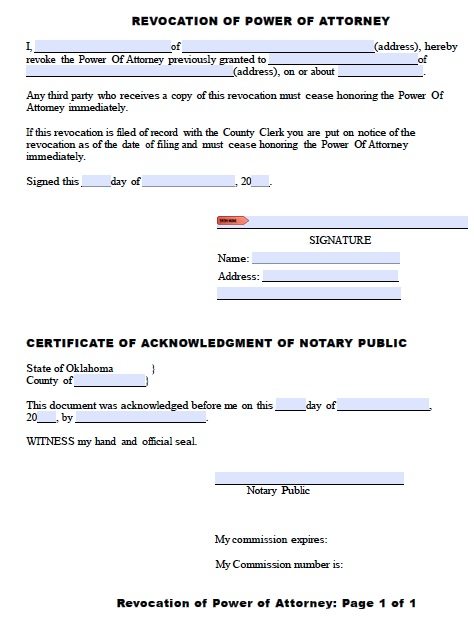

This article is written for persons living in the united states individuals who have made a power of attorney in another jurisdiction should check the laws for that jurisdiction as the requirements to legally revoke a power of attorney are different from place to place.

The principal revokes the agent s authority or the agent dies becomes incapacitated or resigns and the power of attorney does not provide for another agent to act under the.

The power of attorney provides that it terminates.

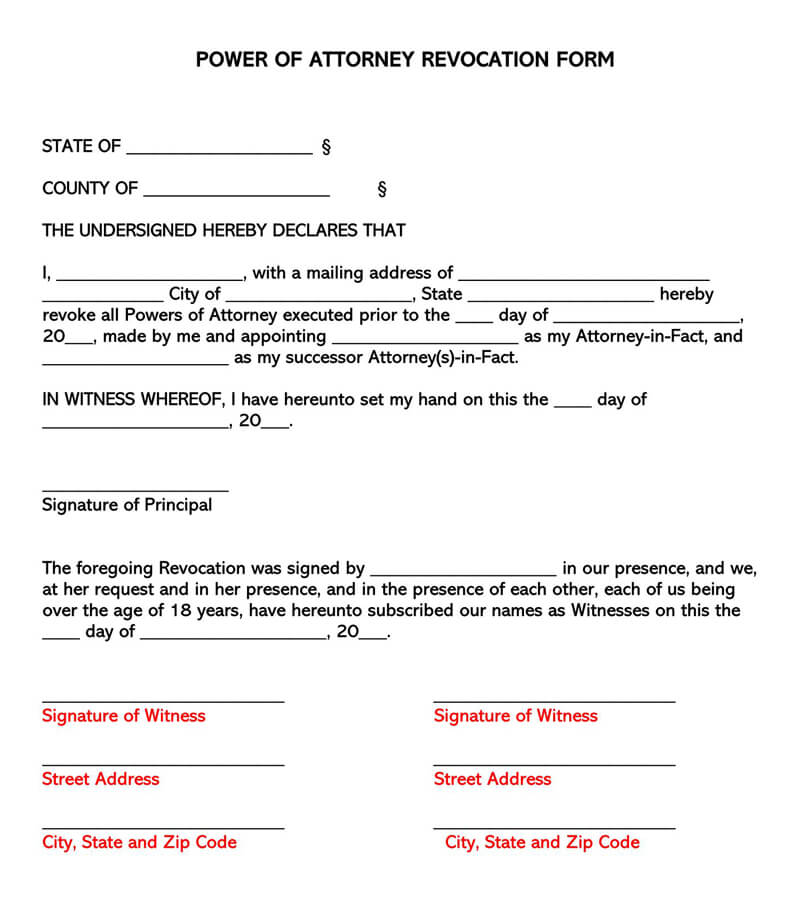

Authorizes a power of attorney revocation form.

As the name suggests you can revoke or cancel the power and authority previously granted to an agent.

Revoking a power of attorney document in the united states is a relatively simple process but it requires precise steps.

Revoke a prior power of attorney authorization.

Authorize a person to discuss designated tax matters with virginia tax and receive correspondence on your behalf.

Under statute 64 2 1602 all power of attorney forms are considered durable which means that the representative s authority will continue to be effective even if the person being.

Virginia power of attorney forms grants a resident to appoint an individual to handle financial medical tax filing or motor vehicle related matters on their behalf.

455 632 26 81.

Any revocation will be effective if the principal either.

The purpose of the power of attorney is accomplished.